Opinion

Who really holds the cards: Trump’s economic power or the bond market’s quiet control?

DCM Editorial Summary: This story has been independently rewritten and summarised for DCM readers to highlight key developments relevant to the region. Original reporting by The Conversation, click this post to read the original article.

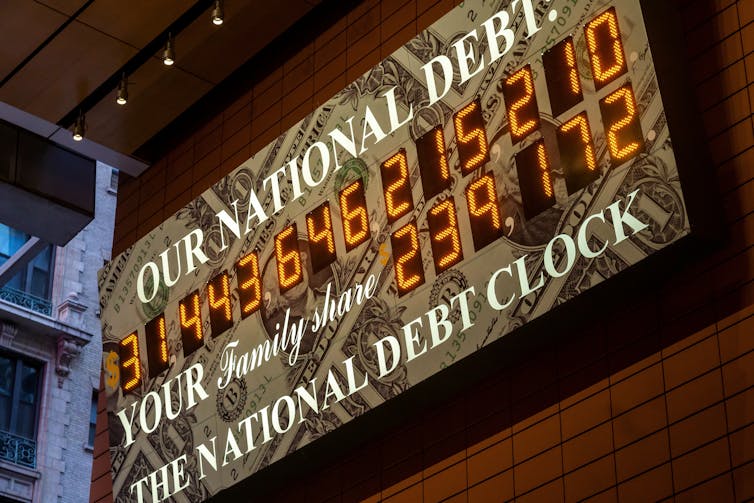

When you hear that a Danish pension fund sold $100 million in U.S. government bonds, it may not seem like much against America’s $30 trillion debt. But it highlights a deeper issue—foreign investors, especially Europe, hold a massive portion of U.S. debt, around $9.5 trillion of it. Europe alone owns $3.6 trillion. Some wonder whether this financial power could offer political leverage, especially after former President Donald Trump’s provocative comments about Greenland and European sovereignty. However, Trump argued at Davos that the U.S. still controls the cards, warning of “big retaliation” if European nations sold off U.S. assets in protest.

Even if your government wanted to use its influence to pressure the U.S., it wouldn’t be easy. Most U.S. bonds in Europe are held by banks, pension funds, and insurance companies—not by governments directly. These institutions manage everyday people’s savings and operate independently. Coordinating a massive sell-off is not only complex but risky. And then you’d have to figure out where to park that money. The U.S. Treasury market is the largest in the world—there’s no easy or safe alternative of that scale.

If Europe tried shifting its investments rapidly into euros, it might end up hurting itself. A huge move like that would likely drive up the euro’s value, damaging European exports and possibly triggering a recession. European institutions depend heavily on U.S. Treasuries, so a hurried exit could jeopardize their own financial health. That’s precisely why even China, despite bold talk, has never fully acted on similar threats. In today’s interconnected markets, using government bonds as political tools often means shared economic pain.

Still, that doesn’t mean the U.S. is immune. America depends more than ever on global investors to fund its growing deficit. Each year, your country needs both foreign and domestic buyers to absorb new debt quietly and consistently, based on trust in the U.S. system. Actions that disrupt this confidence—like trade wars or using economic power for political gain—can create discomfort in financial markets. Investors might become wary, and that could push up interest rates across the board, raising costs on everything from mortgages to businesses loans and government spending.

In the end, while Trump may believe he has all the leverage, the reality is more complicated. You’re operating in a debt-heavy global economy where financial markets, especially the bond market, still have a powerful say. Even the strongest economies can’t ignore the long-term consequences of shaking investor confidence.